For many who’lso are an excellent Citibank customer on the nation, playing with an atm might be a terrific way to get You Bucks for less fees. Before racing for the nearby service to change your currency in order to USD, very first take time to understand this action. Here are pair of use things that can finest prepare yourself you. Several big financial institutions are based in the town, including the Chicago Panel Possibilities Exchange (CBOE), JPMorgan Chase and the Chicago Mercantile Replace.

Another important basis when it comes to to shop for home inside Illinois try the available choices of rental property plus the need for it. In the Illinois, 72.1% men and women individual the brand new belongings it live in, when you’re 27.9% book him or her. Which is a high amount to have control, but there is however need for apartments here. Currently, a projected 8.7% from apartments are unoccupied, that will mean that you will find big demand for the fresh apartments regarding the condition. Approvals in under 24 hours, romantic the loan within the a couple of days—zero appraisals! Simple Road’s EasyBuild mortgage system will bring hard money design finance for builders strengthening properties.

Be aware of the actual exchange rate

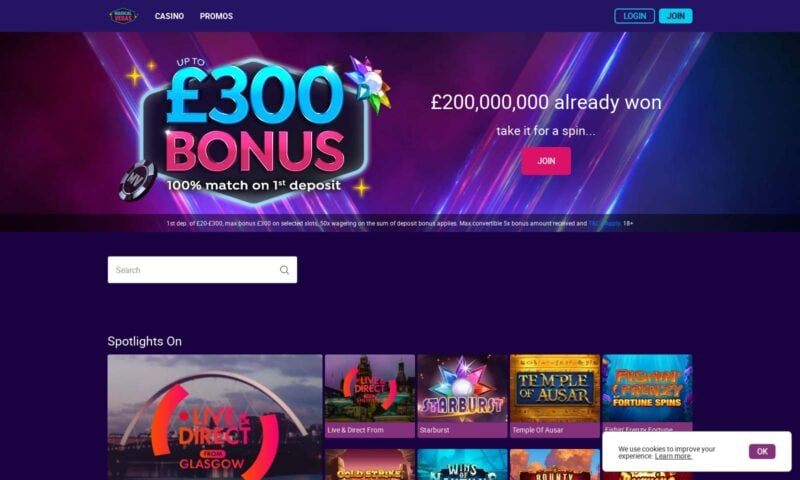

Like mobileslotsite.co.uk blog link that, you’ll learn whether or not you’lso are obtaining cheapest price you can. While using an atm, ensure that you constantly want to perform the purchase inside Us Cash. Certain ATMs often ask you for those who’d choose to getting charged of your home money.

When usually the sun’s rays emerge in the Chicago? What to anticipate and when

Rental output in the Chicago are also glamorous, with the common book of approximately $dos,350 per month, centered on July 2024 analysis of RentCafe. This will make Chicago appealing to buyers looking for strong rental earnings. Whatsoever, there are many a method to separate the give on the rest of the pack, of repair and you can inspection contingencies on the render price, delivering creative tends to make the give excel drastically. We investigated hard money’s plans and you will displayed her or him the things i is looking to do and simply this way they managed to get you can.

- Fairview merely gives its very own finance and you may personally formations for each purchase to complement the needs of the new debtor.

- Complete, difficult money lending is a valuable funding for real home people and investment property citizens in the Chicago who need fast access in order to investment and you may enjoy the flexibility out of difficult currency financing.

- This type of concessions try independent from rate decrease and include currency for the solutions, settlement costs or mortgage-price buydowns.

- Having parts offering downtown luxury and residential district peace, Chicago has tons available.

- “Mortgage prices try unrealistic to fall except if all the the fresh tariffs try removed, or if the world drops to your a fairly really serious market meltdown — which may slash housing budgets for many Us citizens.”

- Illinois law claims one coastlines on the River Michigan try social property up to the newest “drinking water range,” an enthusiastic imprecise basic who has left place for translation.

Quicker you treatment property and sell or refinance they, the more cash you create. The fresh taxation advantages gave the new weakest threat of enduring an issue to own a good worthlessness deduction according to borrowed money in which the new result wasn’t clear. All the debt used in Trump’s worthlessness deduction are considering one to high-risk reputation. As he registered their 2008 income tax come back, he announced business losses away from $697 million. Income tax info do not fully let you know and this businesses made you to definitely shape.

Getting rehabbers our selves, this is a huge advantage to our individuals as we know exactly what demands of a lot borrowers find whenever talking about loan providers and we strive to ensure the individuals is actually averted no matter what. You will find novel opportunities and you may pressures inside the Chicago as well as people try bringing virtue and working together of those daily. All Liberties Arranged.From the submission an application on the the site your agree to discovered sales email communication from EquityMax. EquityMax provides multiple borrowers with many different active money in our collection.

Although not, only a few a home brokerages are prepared up to hold earnest money. Should your seller’s a house broker cannot hold serious money then at times possibly the fresh customer’s home brokerage or even the seller or client’s attorney tend to hold the serious money alternatively. Serious money is usually transferred the afternoon it is received so ensure that cash is on your account when you drop from the look at otherwise cable the money.

Our very own conditions be sure small turnaround moments and they are fitted to investment steps anywhere between purchase-and-keep, fix-and-flip, BRRRR Approach, and a lot more. As one of the finest hard money lenders inside the Chicago, we work with buyers everyday who’re searching for flip/rehabilitation possibilities inside Chicago. As one of the better hard currency lenders inside Chicago, we work with investors every day that are trying to find foreclosure opportunitites.

Which comes at the cost of somewhat higher interest rates, ranging from 5 so you can 15%. Yet not, those individuals rates stay-in spot for a smaller name, and most consumers can also be refinance for the less interest mortgage within this a matter of weeks otherwise ages, keeping will set you back much more responsible. Such professionals build tough currency money popular with of a lot individuals. Metropolitan areas for example Bucktown and you will Lincoln Playground render enjoy features. These focus of several buyers and tenants, and make these parts appealing to own investment18. At the same time, the new South side and you can Austin are receiving inexpensive.

What is the finest market for an amateur trader?

“It’s a catch-22 to possess homeowners,” Chen Zhao, Redfin’s direct away from economics lookup, published within the a can declaration. “Financial costs are unrealistic to fall except if the the newest tariffs are eliminated, or if the world drops to the a fairly serious credit crunch — which will reduce houses budgets for the majority of People in america.” But not, catalog is rising in many locations, particularly in the newest South, providing people more control to negotiate prices.